The China Public Security Bureau last month published a list of the online scams on their website to warn people of the usual scammers' tricks and how to avoid online financial scams if we happen to encounter it.

The report was a very comprehensive list consisting of 60 methods used by the scammers.

The methods used were summarized by the China Public Security Bureau into the followings categories:

- Impersonating officials.

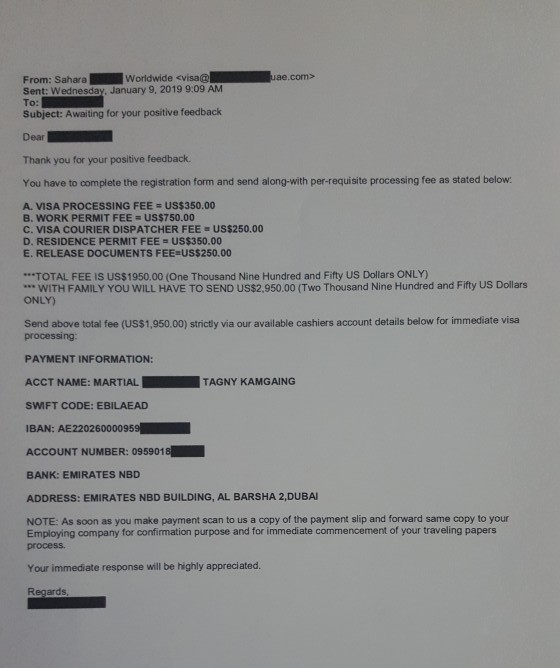

- Purchase scams.

- Events/Activities scams.

- Incentive inducement scams.

- Fictitious claims scams.

- Daily living scams.

- Trojan Horse, phishing scams.

- Other new illegal cheating scams

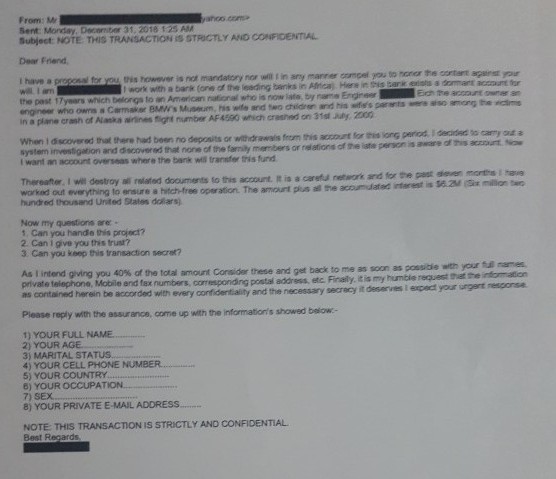

1. Impersonating officials/ other people identities.

a. Impersonating some leaders to cheat:

The scammers impersonate some leaders to make calls to some heads of departments on the pretext of selling books; or some memorial coins to scam the departments concerned to remit money to the designated bank accounts.

b. Impersonating relatives to scam:

Using Trojan Horse malware to obtain target internet user names and passwords. After obtaining the required IM information, following that, they use the targeted user's ID and password to inform the relatives that there has been an emergency or accident and thereafter requested the relatives to remit money to some accounts.

c. Impersonating CEO s of companies:

Scammers use the companies internal communication system to understand the communication between the CEO and the employees. After that they impersonate the CEO to instruct the staff to transfer some money to their accounts.

d. Scam on subsidies, scholarships and study grants:

Impersonating education officials, relevant authority or officials to call or send short messages to parents or students, claiming they can help to get the money needed by them. After that they then ask the victims to provide the necessary cards' numbers, then instruct the victim to transfer some money in order to receive the main money.

e. Impersonating police officers:

The scammers call the victims and inform them that they are from the police department and tell the victims that their personal data has been used in some illegal money laundering transactions, therefore they need to transfer the money to the national bank accounts in order for them to assist in some investigations.

f. Impersonating identity:

Scammers act like they are some rich and highly qualified persons. After gaining the trust and confidence of those they call, they will then pretend there are some financial issues or their relatives badly need some financial assistance and so try and scam their friends.

g. Medical insurance and social security scams:

The Scammers act like they are from the Medical insurance or Social Security departments and inform the victims that there are some irregularities in their accounts , because of this they need to do some investigations. Afterwards they use their new status to convince the victims to give them the necessary information.

h. Guess who I am:

Scammers call the victims and ask them to guess who they are. They pretend they know each other very well, after which they will proceed to borrow money from their unsuspecting victims. Because of that, some victims fail to verify the identity of the callers and straight away remit the money to the bank account provided by the scammers.

The above is the first series of the information on Online Financial Scams

Don't fall for the online financial scams, and to understand more about financial scams, you may want to read this book, to gain more insight of it

If you have any questions or wish to share your experience on this topic, please feel free to leave your comments, questions and your experience in the feedback space below.

I would be glad to get back to you and thank you for your feedback, comments and sharing of your experience.