Online scams keep changing, and recently, scammers have cooked up a scheme that taps into the popular “sugar mummy” narrative and sneaky hotel charges. This trick is catching people off guard, mostly because it mixes flattery with some fake logistics that seem legit at first glance. I've noticed a lot of chatter about it online, so breaking down how it plays out and what you should pay attention to can really help folks steer clear of trouble.

Understanding the Sugar Mummy Hotel Charge Scam

The sugar mummy scam has been around, but this hotel charge twist is getting even more convincing these days. You might get a random message, usually on WhatsApp, Facebook, or even over text, from someone claiming to be a wealthy older woman looking for companionship or a special kind of “connection.” Their profile pictures typically look eye-catching and expensive, and their grammar might be oddly perfect or weirdly awkward, depending on who's behind the scam.

After some light conversation, this so-called “sugar mummy” says she wants to meet you. Here’s where the hotel piece comes in. She claims she’s set up a meeting at a high-end hotel, but before anything can happen, she says you need to pay some sort of hotel-related fee or “registration charge.” Sometimes, they say there’s a refundable deposit, VIP security, or paperwork that needs advance payment. The amount can be tiny—maybe just a “booking fee”—or much larger for what they call exclusive experiences.

The catch? There’s never a real meeting. Often, the hotel doesn't exist, or the registration is just a form the scammer has made up. Once you’ve paid, the sugar mummy vanishes, or she invents new reasons to ask for even more money.

How This New Scam Works Step-by-Step

These setups often look pretty coordinated, so knowing every step helps you spot them quicker. Here’s how the scheme usually unfolds:

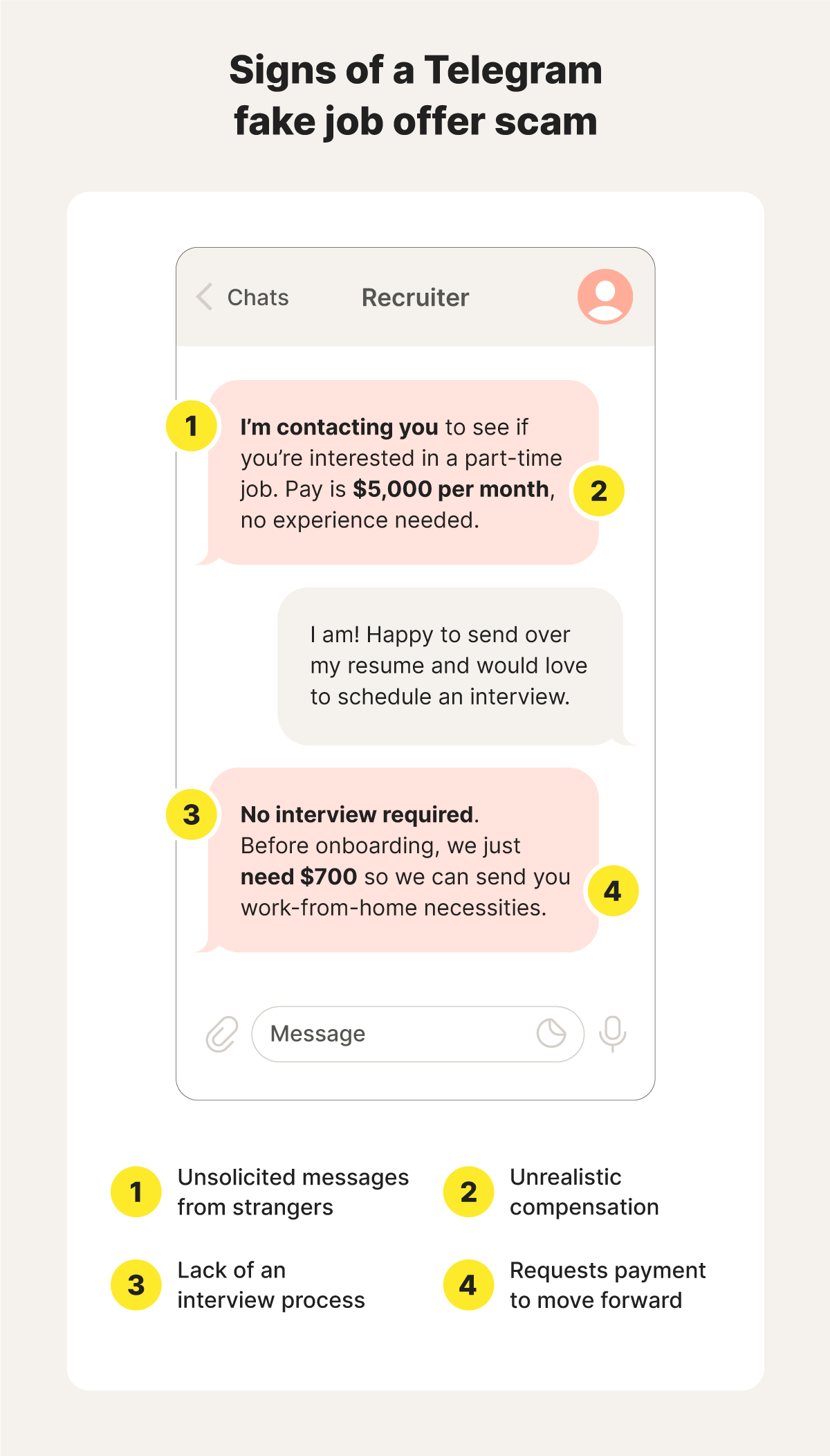

- Initial Contact: You receive a message out of the blue, usually loaded with flattery or an irresistible offer.

- Relationship Building: The scammer chats, asks basic questions, and builds trust. Sometimes, they toss in made-up photos or dramatic stories to seem relatable.

- Proposal for a Meeting: The sugar mummy introduces the idea of meeting at a hotel, typically described as low-pressure, but with the promise of gifts or even cash.

- Introduction of Hotel Fees: Suddenly, you’re told that hotel management wants advance registration, an insurance deposit, or another kind of booking fee, usually to be paid online or with a new phone payment link.

- Payment and Disappearance: As soon as money changes hands, the excuses roll in. Sometimes more fees pop up; in most cases, you never hear from the scammer again.

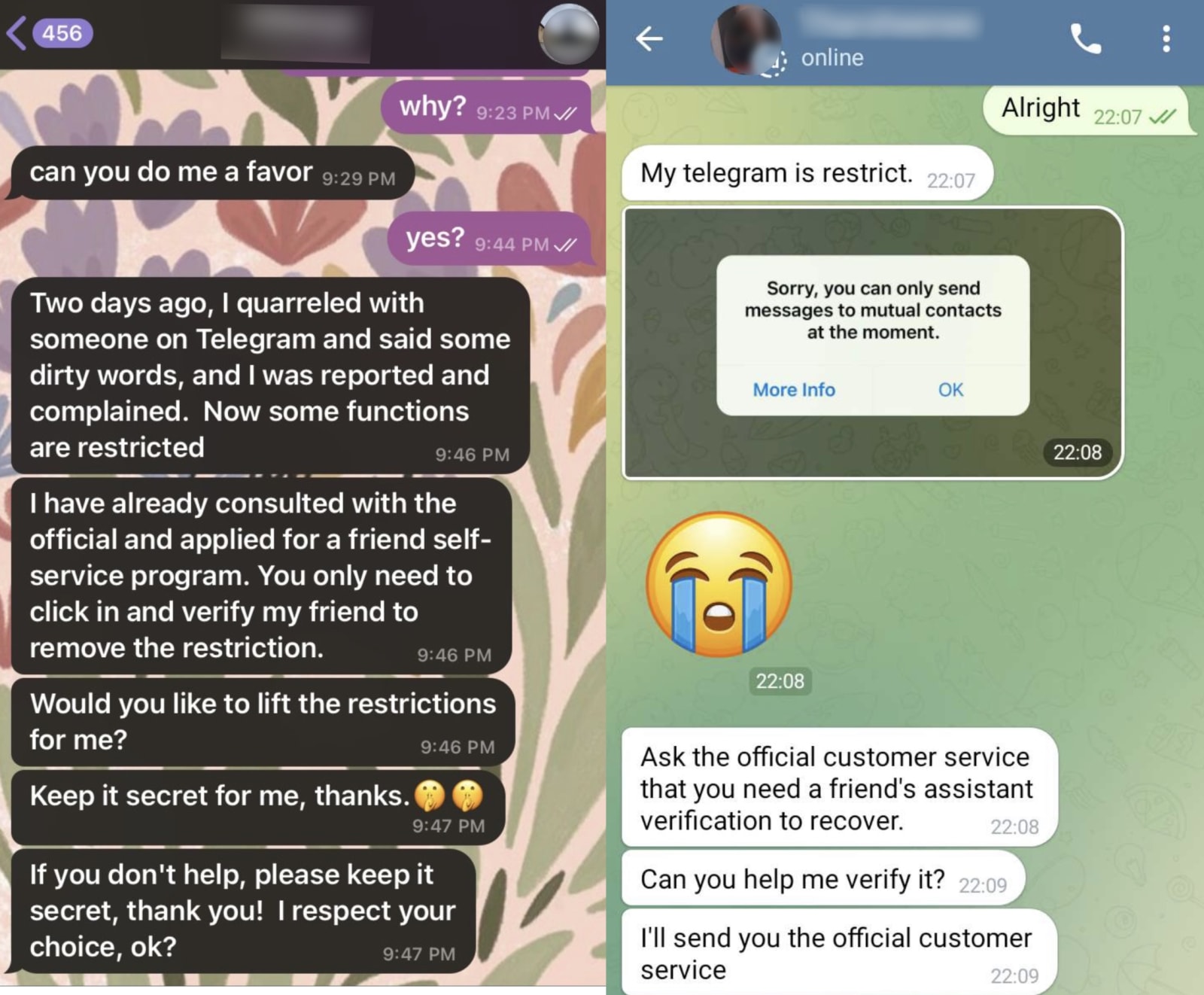

Popular Tactics and Tricks Used by Scammers

Inventive lies fuel this scam, and it's good to know the most common tricks:

- Fake Hotel Agents: Another contact, playing the role of hotel staff or security, reaches out for fees, using fake hotel IDs or made-up receipts as proof.

- Pushy Messages: They flood your messages with emotional reminders (“I’m waiting!” or “Just pay so we can see each other!”), making you feel like you'll miss out if you hesitate.

- Promise of Refunds: You’re told the charges are refundable at the hotel, but that turns out to be a lie after you pay.

- Social Proof: To look real, they drop in fake chats, photos of cash or hotel rooms, and phony reviews.

- Phony Invoices: You’ll see professional-looking invoices or confirmations, complete with fake logos and reservation numbers.

All these tactics work to lower your suspicion, so sending money feels less risky and more routine.

Why the Sugar Mummy Hotel Scam Works So Well

It's surprising how these scams can take off with so many. Here are a few reasons they're so successful:

- Emotional Manipulation: Flattery and focused attention make you feel important, which can mess with your judgment.

- Sense of Urgency: Tight deadlines and urgent requests push you into action without giving you time to think things through.

- Social Desirability: The idea of sudden wealth, generous gifts, or a dream relationship is a powerful lure. It makes the target feel like the luckiest person around.

- False Authority: Bringing in fake hotel staff and sharing doctored documents helps everything seem more official and legitimate.

Even savvy people can fall for these, especially when emotions are running high.

Red Flags to Watch Out For

The sooner you spot the warning signs, the easier it is to protect yourself. Here’s what stands out most:

- The approach is too generous or moves way too quickly.

- Their online profile has few friends, newly uploaded photos, or feels suspicious on close look.

- They want to move the chat to private platforms, like WhatsApp or Telegram, right away.

- You're asked to pay a hotel or agent you can’t confirm, using odd payment platforms or wallet apps.

- The invoice, receipts, or “official” documents have sloppy typos and strange formatting styles.

- If you suggest a video chat or put off paying, they get angry or suddenly have excuses.

Trust your instincts and always double-check anything that feels off. That extra caution usually pays off in the end.

Tips to Protect Yourself from Sugar Mummy Hotel Scams

Guarding yourself from these setups can be straightforward if you take a few steps. Here's what I recommend:

- Never Pay Someone You Haven't Met Face-To-Face: Don’t send money for hotels, rides, or “registration” to an online stranger, no matter how convincing they seem.

- Check Hotel Details: Look up the hotel online. Call them using their number from the official website to confirm policies and bookings.

- Investigate the Payment Method: Research the payment type. Many scammers use hard-to-track or untraceable payment apps.

- Request Video Proof: Ask for a live video call, video message, or at least a voice note. If they always find excuses, something’s wrong.

- Bring in Trusted Friends: Share the details with friends or family. A second opinion makes spotting a scam a lot easier.

- Report and Research: Use scam reporting tools like Scamwatch, or check with your local cybercrime unit for fresh warnings about trending tricks.

These practical steps can help you avoid a financial hit and a bunch of headaches down the road.

Common Variations on the Hotel Scam

Scammers often mix things up, so being aware of these anytime the details feel odd is useful:

- “VIP Conference” Traps: Instead of a hotel room meeting, the scam is about a fake business conference, party, or club event, where upfront registration is needed. Nearly identical in structure to the main scam.

- Fake Escort Brokers: The persona shifts to an escort or matchmaking service, supposedly representing wealthy clientele—fees are required before introductions.

- Pretend Travel Arrangements: You’re told travel or hotel costs must be paid for luggage insurance, upgrades, or even car rentals. Sometimes a forged airline receipt gets thrown in.

- “Upgrade Fees”: If you hesitate, the scammer suddenly claims there's an unexpected “upgrade” charge to make the meeting safer or more exclusive. It's just another excuse for cash.

Scammers are always mixing things up. But their stories don't really matter—the demand for upfront payment is the giveaway every time.

Examples of Real Victim Experiences

Nothing gets the point across like personal stories. Here are a few actual experiences shared on online forums and social groups:

- Michael, 27: Chatted with a “sugar mummy” from Facebook. Paid a so-called VIP meeting charge to a hotel manager. Never saw a refund or the person.

- Peace, 35: After weeks on WhatsApp, got sent a bogus “booking receipt” from a so-called fancy hotel. Tried verifying with the hotel but couldn't. The money went to someone via a general mobile payment.

- Godwin, 22: Spent on multiple supposed hotel fees—first for the room, then security, then even a made-up confidentiality agreement. None of it was real; the scammer kept inventing charges.

Losing money is bad, but embarrassment stings the most for many. By keeping these stories out there—without shaming anyone—more people will stay on guard.

Why Victims Often Don’t Report These Scams

Plenty of folks don't bother to report these scams. Here’s why, based on stories I've seen:

- Embarrassment: The worry about being mocked or judged makes them keep quiet.

- Tough to Gather Proof: Most of it's just online chat or calls, so collecting real evidence feels impossible.

- Uncertainty About Reporting: They're not sure which agency deals with it, especially if it spans different countries.

- Feeling Like It's Hopeless: Once time passes and the cash is gone, they see no benefit in making noise.

Still, opening up in a private online group or chat room can help warn others or give information to investigators.

How to Report Sugar Mummy and Hotel Charge Scams

Reporting these scams really does help make them less effective over time. Here's a step-by-step plan for anyone who's been targeted:

- Gather Evidence: Screenshot every message, fake invoice, and payment request. The more records, the better.

- Use Scam Databases: Search Scamwatch or similar services to see if your experience matches recent scam patterns.

- Report to Authorities: File a report with national police or anti-cybercrime bodies. Online report forms are common and easy to use.

- Contact Your Bank: If you've paid by card, call your bank immediately about reversing the charges.

- Warn Others: Share what happened in a way that's safe—on review boards, forums, or social feeds—so more people spot trouble earlier.

Your lost money may not always come back, but reporting helps lower the scam's reach and impact.

Frequently Asked Questions About Sugar Mummy Hotel Scams

Here are questions I'm often asked about these setups:

Question: How do scammers find their victims?

Answer: Usually by approaching strangers on social media, messaging apps, or dating platforms. Sometimes through leaks of phone numbers or emails.

Question: What should I do if I already sent money?

Answer: Act quickly—get in touch with your bank or payment provider, and file a police or cybercrime report with all your screenshots and documents.

Question: Can this scam be used for other types of “sugar offers” or promises?

Answer: Absolutely. The same structure works for sugar daddy, celebrity meetings, high-end jobs, or any scenario with someone supposedly wealthy who needs you to pay fees in advance.

Question: Why do they use hotel or registration fees instead of straight-up asking for money?

Answer: Presenting it as an official hotel or event charge makes the request look more legitimate, lowering your guard and making you more likely to pay.

Question: Is it ever safe to meet someone from the internet at a hotel?

Answer: Only if you’ve independently confirmed who they are and double-checked details with the hotel directly. Meeting in public places and bringing friends is always safest for a first-time meet.

Final Thoughts

Staying alert and questioning offers that sound too good to be true protects you from costly mistakes. As online scams keep changing, sharing stories and tips makes it much easier for everyone to watch each other's backs. If something feels strange, listen to your instincts, look into every detail, and never feel pressured to pay on the spot—no matter how convincing or fancy the story is.

For up-to-date info on the latest scam tactics and staying safe online, check out resources like FTC Scam Alerts or Action Fraud UK. If you find yourself targeted, remember—you’re not alone, and reporting your story makes a difference for the whole community.