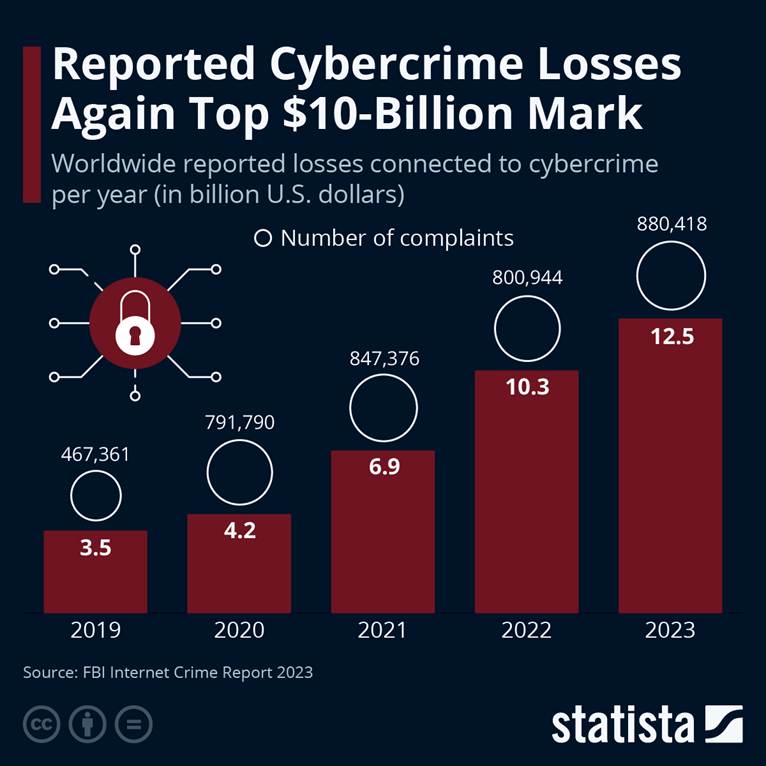

Investment scams are becoming increasingly sophisticated as more people search for ways to grow their savings and build financial security. With the rise of online trading platforms, cryptocurrency investments, and social media marketing, scammers now have more opportunities than ever to reach potential victims.

According to global fraud reports, investment scams consistently rank among the highest in financial losses worldwide. Victims often lose thousands or even millions of dollars because fraudulent schemes are carefully designed to appear legitimate.

Many victims only realize they have been scammed after it is too late. However, most investment scams share several common warning signs. Learning to recognize these red flags can help investors avoid becoming victims.

Here are 10 important warning signs of investment scams in 2026.

1. Guaranteed Profits With No Risk

One of the biggest red flags in any investment offer is the promise of guaranteed profits.

In legitimate financial markets, every investment carries some level of risk. Even experienced investors and large financial institutions cannot guarantee consistent profits.

Scammers often advertise returns such as:

- “Guaranteed 20% monthly profit”

- “Risk-free investment opportunity”

- “100% success rate trading system”

These promises are designed to attract people who want quick financial gains.

In reality, if an investment opportunity claims high profits with zero risk, it is almost certainly fraudulent.

2. Extremely High Returns Compared to the Market

While high returns are possible in certain investments, they usually involve significant risk.

Fraudsters frequently promote opportunities that promise returns far above normal market performance.

For example, they might claim:

- 30–50% profit within a few weeks

- doubling your investment in a short period

- daily profits through automated trading systems

These numbers are unrealistic compared to legitimate investment returns.

Even successful long-term investors rarely achieve such consistent performance.

3. Pressure to Act Immediately

Scammers often create urgency to prevent victims from researching the opportunity.

They may say things like:

- “This investment opportunity is only available today.”

- “You must join before midnight.”

- “Only a few spots are left for selected investors.”

By creating time pressure, scammers reduce the chance that victims will:

- check the company background

- consult financial advisors

- discuss the opportunity with family or friends

A legitimate investment opportunity will still be available after you take time to evaluate it carefully.

4. Unsolicited Investment Offers

Another major warning sign is receiving unexpected investment offers from strangers.

These offers may arrive through:

- WhatsApp messages

- social media platforms

- email promotions

- cold phone calls

In many cases, scammers introduce themselves as professional financial advisors or investment experts.

However, legitimate financial institutions rarely approach individuals randomly with exclusive investment opportunities.

If someone you do not know suddenly offers you a profitable investment, you should be extremely cautious.

5. Unlicensed or Unregistered Advisors

Professional investment advisors are usually required to hold licenses or register with financial regulatory authorities.

Scammers often avoid proper licensing because it would expose their fraudulent activities.

Before investing money, always verify whether the individual or company is registered with the relevant financial regulator.

In many countries, regulators maintain online databases where investors can check licensed advisors.

If the promoter refuses to provide verifiable credentials, it is a strong warning sign.

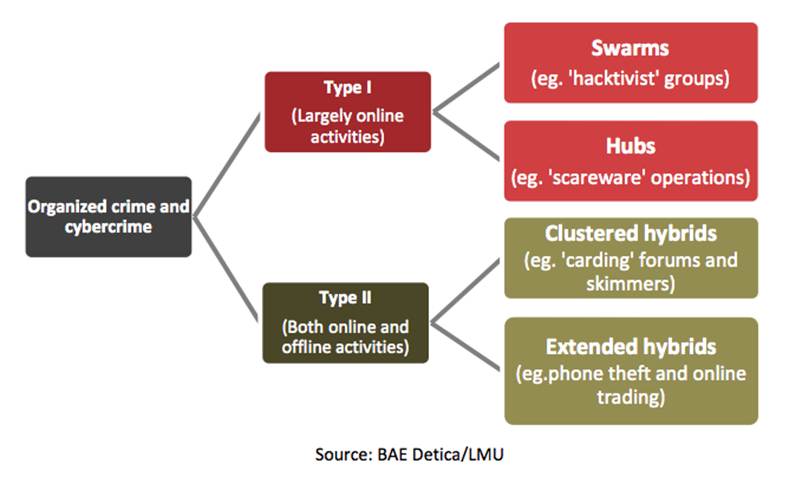

6. Complex or Secretive Investment Strategies

Some scammers use complicated explanations to confuse potential victims.

They may claim their profits come from:

- secret trading algorithms

- insider market techniques

- exclusive investment strategies

When victims do not fully understand the explanation, they may assume the promoter possesses special expertise.

However, legitimate investment professionals should be able to explain opportunities clearly and transparently.

If an investment strategy sounds overly complicated or secretive, it is wise to be skeptical.

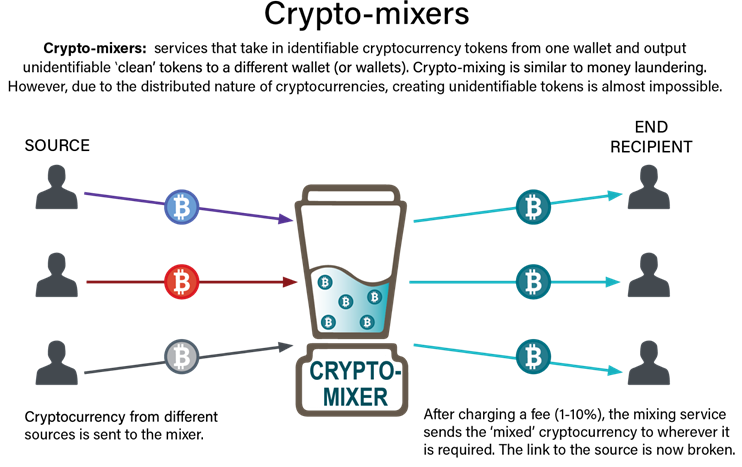

7. Requests for Unusual Payment Methods

Fraudsters often ask victims to transfer funds through unconventional payment methods.

Common scam payment requests include:

- cryptocurrency transfers

- prepaid gift cards

- international wire transfers

- online payment wallets

These payment methods make it difficult to trace or recover funds.

Legitimate investment firms typically use regulated banking channels and documented transactions.

If someone insists on receiving payment through unusual methods, it should immediately raise suspicion.

8. Fake Testimonials and Reviews

To appear credible, scammers often display testimonials from supposed satisfied investors.

These testimonials may include:

- photos of luxury lifestyles

- screenshots of large profits

- stories from happy clients

However, these testimonials are frequently fabricated.

In some cases, scammers even steal photos from social media accounts to create fake success stories.

Before trusting such testimonials, investors should verify whether the individuals actually exist and whether their experiences are genuine.

9. Difficulty Withdrawing Funds

A common pattern in investment scams occurs after victims deposit money.

Initially, scammers may show fake profits on an online dashboard to encourage additional investment.

However, when victims attempt to withdraw funds, problems suddenly arise.

Common excuses include:

- additional fees required for withdrawal

- tax payments before funds can be released

- technical issues delaying the transaction

Eventually, victims realize they cannot access their money at all.

If an investment platform makes it difficult to withdraw funds, it is a serious warning sign.

10. Requests to Recruit New Investors

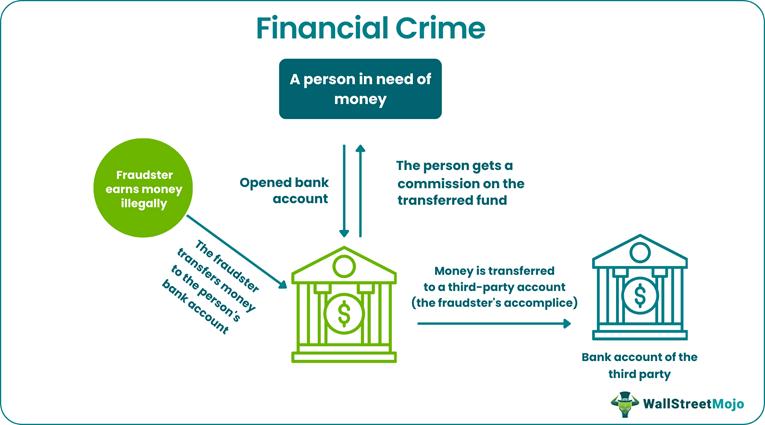

Some fraudulent investment schemes operate like pyramid or Ponzi schemes.

Victims may be encouraged to recruit friends or family members to join the investment program.

Promoters may promise additional commissions or bonuses for bringing in new investors.

However, such schemes rely on new deposits from later participants to pay earlier investors.

Once recruitment slows down, the entire scheme collapses.

If an investment opportunity focuses more on recruiting people than on actual business activity, it is likely fraudulent.

How to Protect Yourself From Investment Scams

Preventing investment fraud requires caution and careful research.

Before committing money to any investment opportunity, consider the following steps:

- verify the company’s registration and licensing

- research independent reviews and reports

- consult trusted financial professionals

- avoid making decisions under pressure

- discuss the opportunity with family or friends

Taking time to verify information can significantly reduce the risk of falling victim to scams.

Final Thoughts

Investment scams continue to evolve as technology and financial markets change. While scammers use increasingly sophisticated tactics, the underlying warning signs often remain the same.

By recognizing these 10 common red flags, investors can better protect their savings and avoid costly mistakes.

Remember that legitimate investments require careful evaluation and realistic expectations. If an opportunity sounds too good to be true, it probably is.

Financial success should be built through knowledge, patience, and informed decision-making, not through promises of easy profits.