Online scams are everywhere these days, and if you’ve ever wondered why people—even smart, cautious folks—keep falling for them, you’re definitely not alone. Even with all the warnings out there, the number of victims doesn’t seem to be going down much. I’m always hearing questions about why these scams work so well, so I’m breaking things down here in a way that makes their “secret sauce” pretty easy to spot. Understanding what’s going on behind the scenes can help you or someone you know steer clear of the next sneaky trick that pops up online.

How Online Scams Have Evolved and Spread

Online scams have changed a lot since the early days of the internet. Back then, scams were mostly clumsy, obvious spam emails loaded with bad grammar and over-the-top promises. Fast forward to today, scammers are pulling off elaborate cons using personal details, fake websites, and sometimes even AI to make their schemes more believable.

Stats show the scope of the problem. The FBI’s Internet Crime Complaint Center gets hundreds of thousands of reports each year, and the actual losses add up to billions of dollars globally. Phishing, romance scams, investment fraud, and fake tech support are just some types making the rounds. The FTC reports consumers lost nearly $8.8 billion to fraud in 2022 alone, and that’s just the cases we know about.

Scammers have gotten creative, often adapting to whatever news, trends, or crises are happening in the world. They take advantage of social media, messaging apps, and search engines, places we use every single day. This constant mix-up keeps people on their toes, and it means simply "knowing better" doesn’t always protect you.

Another reason scams spread so quickly now is because of the massive amount of data available online. Data breaches, leaked passwords, and public social media profiles all give scammers more ammunition. There are even online marketplaces where personal data is bought and sold cheaply, leading to more targeted and convincing scams. Combined with easy-to-use scam kits and tutorials circulating on the dark web, almost anyone can jump into the game and fool people at scale.

The Psychology Behind Why People Fall for Scams

If a scam wasn’t convincing, no one would fall for it. Scammers count on four main tricks: emotional manipulation, urgency, authority, and familiarity. Understanding these psychological hooks makes it easier to see how they work in real life.

- Emotional Triggers: Scams often play on fear, greed, loneliness, or excitement. Romance scams, for example, are incredibly successful because they build a feeling of connection first.

- Sense of Urgency: Many scams force you to act quickly, like “your account will be deleted unless you click here now!” That rush to make a decision before thinking things through is what gets people most often.

- Fake Authority: Scammers will pose as government agents, bank officials, or tech support. We’re naturally inclined to trust authority figures, especially if we think something important is at risk.

- Looking Familiar: Many scams copy the look of real websites or emails from big companies. Sometimes, scammers use pieces of real information about you to feel more legitimate.

Even experts sometimes get fooled because these triggers are hardwired into how humans make decisions. When you’re tired, stressed, or distracted, it’s even easier to fall for these tactics. Scammers know this and time their messages to catch you off guard.

Humans also tend to rely on cognitive shortcuts when making decisions online. These shortcuts, or heuristics, are efficient most of the time but can backfire in unfamiliar scenarios. Scarcity, for instance, is a classic psychological tactic. You might see “only two left!” on a fake shopping site and feel compelled to buy immediately. Loss aversion—the natural urge to avoid losing something—can make you respond to messages claiming your account will be locked without quick action. Scammers have learned to exploit these basic instincts, blending in manipulative social engineering with the steady drumbeat of digital life.

Common Types of Online Scams and How They Trap People

Online scams come in all shapes and sizes. Here are some of the most common ones and what makes them work so well:

- Phishing Emails: These are fake messages pretending to be from banks, delivery services, or companies like PayPal. The emails often contain links to lookalike websites asking for your login details. Because they look official, people trust them.

- Social Media Scams: Fake profiles might try to befriend you and later ask for money, or you might see an ad for an amazing deal that’s actually a setup. Scammers use memes, messages, or even hacked accounts from people you know.

- Online Shopping Cons: Scam websites can offer gadgets, shoes, or clothes at great prices but never deliver anything. Sometimes, these sites look almost identical to the real thing, complete with reviews and fake ratings.

- Romance Scams: These cons involve forming what seems like a real emotional bond, usually over weeks or months, then asking for money due to some “urgent” situation.

- Investment Frauds: Get-rich-quick offers and flashy crypto schemes are everywhere. They promise big returns, sometimes researched just enough to sound legit, and target anyone hoping to make some extra cash online.

- Tech Support Scams: This is when you get a call, pop-up, or email claiming your computer has a virus. The scammer then tries to take remote control of your device or asks you to buy fake software.

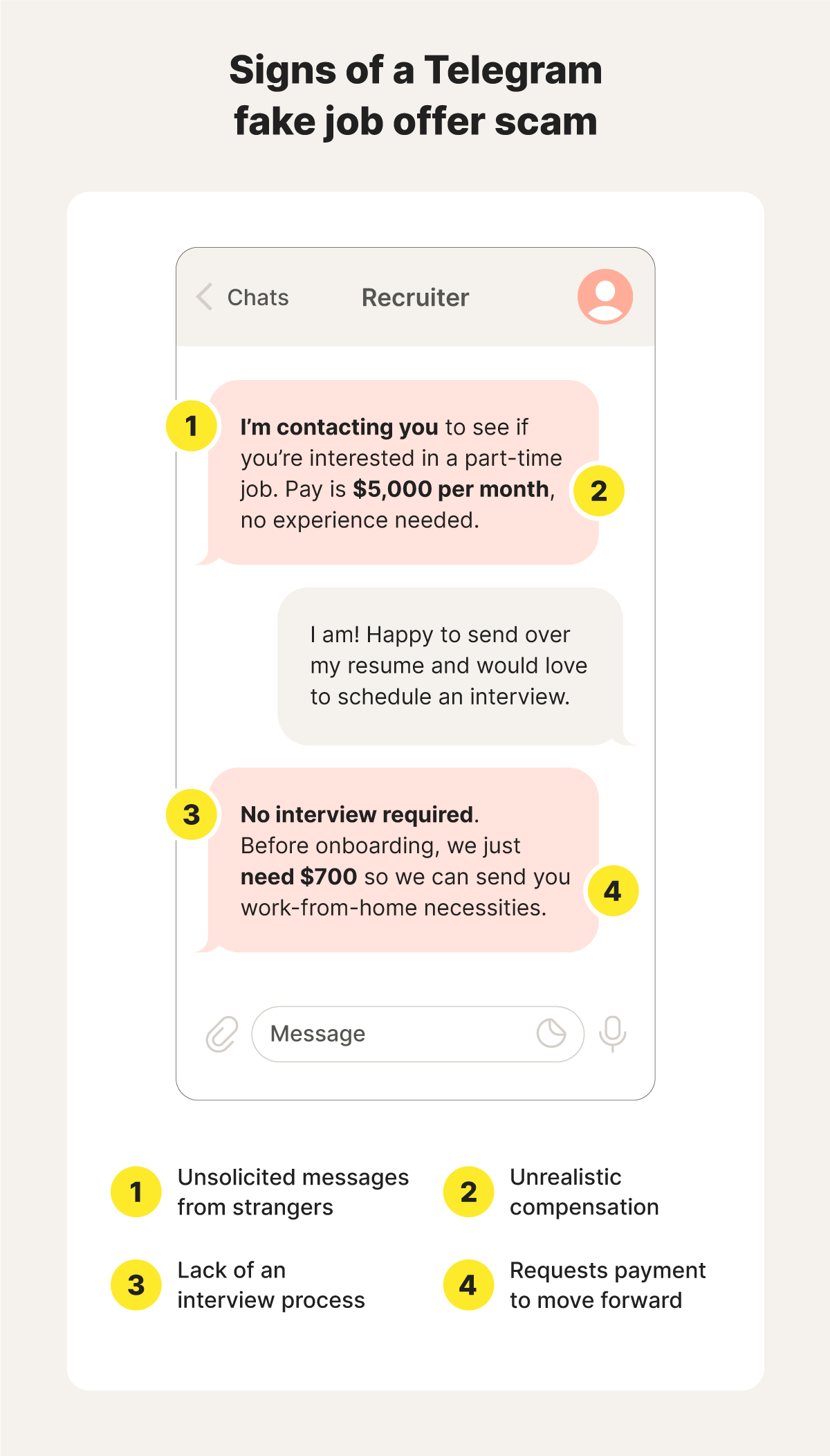

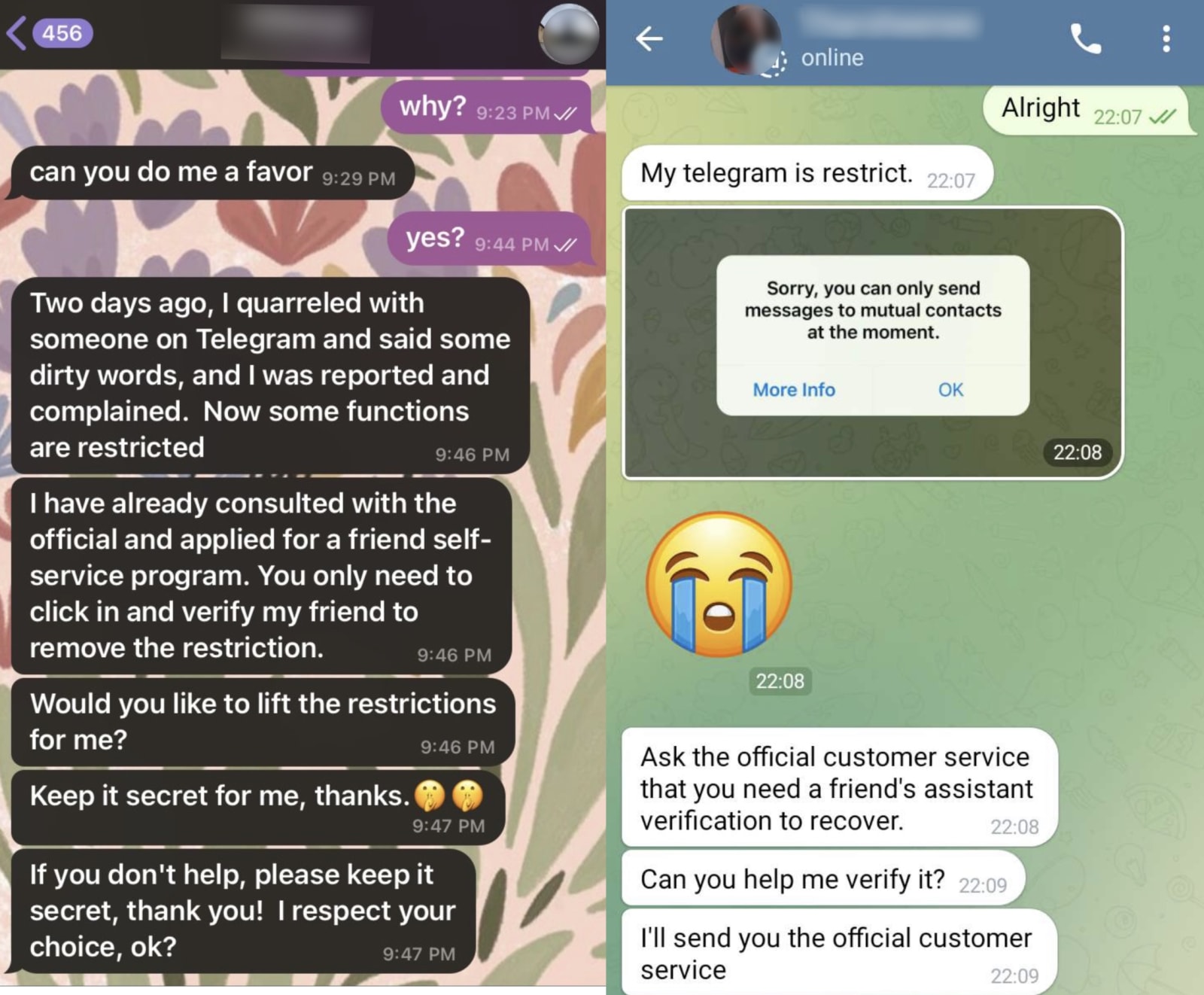

Translating scams to new platforms is a big part of how they keep spreading. Scammers now use messaging apps, online job boards, dating platforms, auction sites, and even video games to find targets. Some set up fake charities after natural disasters, playing on people’s goodwill. Others use tools like deepfake videos to impersonate coworkers or bosses, making wire fraud far more believable than ever. The increased connectivity of our digital world means scammers always have a new stage for their tricks.

What ties these scams together is they take a piece of truth, mix in urgency or emotion, and rely on trust, either in a company or another person. That blend makes the scams feel real, even if your gut says something feels a little off.

Walkthrough: How a Typical Scam Works

It’s handy to look at an example step-by-step. Here’s how a run of the mill phishing scam usually plays out:

- The Bait Arrives: You get an email that looks like it’s from your bank or a favorite store (“There’s an issue with your account!”).

- Urgency and Fear: The message says you need to act now; maybe you’ll lose access or face a fee.

- Click Here: The link inside goes to a website almost identical to the real one. If you’re on your phone, it’s even easier to miss small details.

- Log In Here: When you “log in,” you’re just sending your username and password to a scammer.

- Immediate Aftermath: The scammer might quickly try to access your real bank or email account, sometimes even locking you out or stealing more information before you realize what’s happened.

This style works because, in the moment, everything feels urgent and legit. The layout, tone, and timing are designed to bypass your skepticism and get you to act before you double-check.

Another layer often involves follow-up attempts. Sometimes, after an initial login theft, the scammer will contact you again, posing as the security team to "help" you reset things—when they're really cementing their access. Or they might quietly monitor your accounts, gathering more data to set up future cons. These multi-stage scams show that online fraudsters have grown very sophisticated, thinking through multiple steps and staying patient to maximize what they get from each victim.

Warning Signs To Watch Out For

Knowing what to look for is pretty handy if you want to stay ahead of scammers. Here are some classic red flags:

- Unexpected messages, texts, or calls, especially if they create urgency or fear

- Strange sender addresses or slightly misspelled URLs

- Messages that use generic greetings like “Dear user”

- Requests for personal info, passwords, or payment info over email or text

- Too-good-to-be-true deals or promises of easy money

- Pressure to move a conversation to another channel (like WhatsApp or Telegram)

- Spelling mistakes, awkward language, or odd formatting

Noticing even one of these warning signs tells me it’s time to slow down and double-check. Scammers rely on you being too rushed to notice these tiny clues.

Some less obvious clues include attachments you weren’t expecting, links that, when you hover over them, don’t match the official company’s web address, or strange requests from coworkers, especially those who rarely email you. Being alert for small changes and odd requests is key. On social media, scammers might post “act fast!” contests or prizes that ask for personal info up front. Always think about whether a company would really reach out in such a way.

Things to Keep In Mind: Why Smart People Still Get Fooled

There’s a common myth that only gullible or careless people get scammed, but that’s just not true. I’ve seen stories of tech pros, financial experts, and even cybersecurity pros who were caught off guard. Here’s why anyone can slip up:

- Emotions Override Logic: If a scam pushes the right buttons, like fear, love, or excitement, it’s easy to stop thinking rationally.

- Scams Get Personal: Scammers can use info they find in social media profiles or data leaks to craft scams tailored just for you. If they know your birthday, hometown, or friends’ names, their story seems more real.

- Multitasking: When you’re distracted or dealing with lots at once, you’re more likely to click or give out info without thinking.

- Information Overload: With all the emails, notifications, and alerts we get daily, sometimes something just slips past, especially late at night or when we’re in a hurry.

It’s never about being “dumb.” It’s about catching people at the wrong moment or outsmarting them with something unexpected. Scammers know that, and their methods keep getting smarter.

Smart people also fall for scams because everyone has “blind spots” shaped by experience and personality. If you’re a generous person, charity scams play to that. If you’re highly analytical, a scam with a convincingly detailed backstory can draw you in. Scammers use persuasion tactics, not just tech. Nobody is completely immune.

Real-World Examples and Lessons

People learn best from real stories, so here are a couple I found interesting:

- The Fake Tech Support Call: Someone I know received a call supposedly from their “internet provider” warning about unusual activity. The scammer walked them through downloading remote access software. Only after losing access to some accounts did they realize what happened.

- Romance Scam from an Insta Profile: A friend was contacted by a charming “new follower.” At first it was innocent, but eventually, small gifts and requests for money started showing up. The scam ended when another follower flagged the account for being fake.

Learning from others can really help you avoid being next. Sharing stories, even embarrassing ones, gives everyone more tools to stay safe.

Another real story involves so-called “CEO fraud,” where scammers pose as a company’s CEO and email an employee asking for urgent help with a wire transfer. One small business covered in the news lost thousands because the bookkeeper, eager to help and not wanting to say no, sent the funds. These stories spread awareness and help everyone think twice if they’re ever in a similar spot.

Tips and Strategies for Staying Safe Online

There’s no perfect shield against online scams, but some habits make a big difference:

- Double-Check Everything: If an email or message feels off, go directly to the company website or app instead of following links.

- Use Unique Passwords and Two-Factor Authentication: These steps might seem small, but they help protect you even if one password gets leaked.

- Set Up Alerts: Lots of banks and social media sites offer notifications for new logins or big transactions. These are super useful to catch something suspicious right away.

- Share and Talk: If you get a weird message, talking to someone else, like a friend, coworker, or the company itself, can help you spot a scam before acting.

- Slow Down: Even just taking a moment to think about what’s being asked can stop a scam from working.

- Report Scams: Most email and social platforms make it easy to report suspicious messages. This helps keep scammers off the site.

A few extra ways to boost your safety: keep your devices updated, back up your important data, and use privacy settings on your social accounts to limit what strangers can see. Don’t ever send money or info to someone you haven’t met in person, especially if you’ve only talked online. When in doubt, Google the company or offer along with the word “scam”—often, others have already posted warnings if it’s fishy.

The Technology Side: How Scammers Keep Getting Better

Tech has helped scammers just as much as it’s helped honest people. Some of the ways they’re using new tools include:

- Fake Websites and AI Generated Content: Tools can build entire fake sites or write personalized messages in seconds.

- Robocalls and Spoofed Numbers: Apps let scammers fake caller IDs, making calls look like they’re local or from real companies.

- Harvesting Public Information: Social media scraping lets scammers build profiles that make their approach seem totally legit.

Lots of legitimate companies are fighting back with better spam filters, improved account alerts, and tougher login security. But scammers are clever, and staying up to date with the latest tricks is a good idea for anyone who spends lots of time online. For example, modern security protections are starting to use AI to find suspicious logins, biometrics like fingerprint or facial recognition, and adaptive authentication. Still, scammers work tirelessly to beat new security tools, so nothing is a guarantee.

One trend to watch is "smishing," where scammers use text messages instead of email. These texts often pretend to be from delivery companies like FedEx or financial institutions and include links to malicious sites. Because texting feels more personal and less likely to be fake, many people trust these messages and fall victim. Another growing trick is QR code scams, popping up at restaurants or public places, leading unsuspecting users to phishing sites. Being aware of new tactics helps people avoid falling for them.

Top Questions About Online Scams

Here are a few questions I hear all the time, with some straightforward answers.

Question: Are there certain people more likely to fall for online scams?

Answer: Scammers often target people who show signs of trust or are looking for something specific, like love, work, or investment opportunities. But with the right timing and approach, anyone can be a target.

Question: What should I do if I think I’ve been scammed?

Answer: First, stop any communication and don’t send more money or info. Change your passwords, alert your bank, and report the scam to your country’s cybercrime center or relevant regulatory site. Quick action makes a big difference.

Question: Do antivirus programs protect against online scams?

Answer: Antivirus software can catch malicious attachments or downloads, but it won’t protect you from giving up info on a fake site. Staying alert is your first line of defense.

Question: How can I help friends and family avoid scams?

Answer: Talking openly about scams and sharing recent examples goes a long way. If you spot a scam, spread the word in your networks, and encourage others to slow down and double-check suspicious messages. Simple reminders, like not clicking links from unknown senders or being careful with unsolicited job offers, can keep people safer.

Final Thoughts

Online scams are always changing, and while it’s easy to judge people who get caught, the reality is that these schemes are built to catch everyone off guard. By understanding how scammers think and knowing what signs to watch for, I feel way more confident finding my way online. Staying cautious, asking questions, and spreading the word about new scams I see can help me and folks I care about stay one step ahead. Keep learning and stay curious because the more you know, the better you can protect yourself and others from falling victim next.